Congress Targets Fraud: Billions At Risk & What's Being Done

Is the United States government truly losing billions, even hundreds of billions, to fraud each year? The evidence suggests a resounding "yes," painting a picture of systemic vulnerabilities and a costly struggle to safeguard taxpayer dollars.

The numbers are staggering. Following a surge in improper payments, rising from $41 billion in 2007 to $104 billion in 2009, Congress took action. The bipartisan Improper Payments Elimination and Recovery Act of 2010 (IPERA) was enacted, a crucial step aimed at stemming the tide of financial losses. Yet, despite this legislative effort, the problem persisted. Improper payments continued to climb, reaching a staggering $149 billion in 2018. In response, Congress replaced IPERA with the updated Payment Integrity Information Act, acknowledging the need for further reforms. The Government Accountability Office (GAO) has played a critical role in highlighting these issues. Chairman Comer, in his opening statement, emphasized that the GAO's 2025 High Risk List illuminates the deficiencies within numerous federal programs, including those funded by Congress, which are susceptible to waste, fraud, abuse, and mismanagement. This list serves as a stark reminder of the challenges faced in protecting public funds.

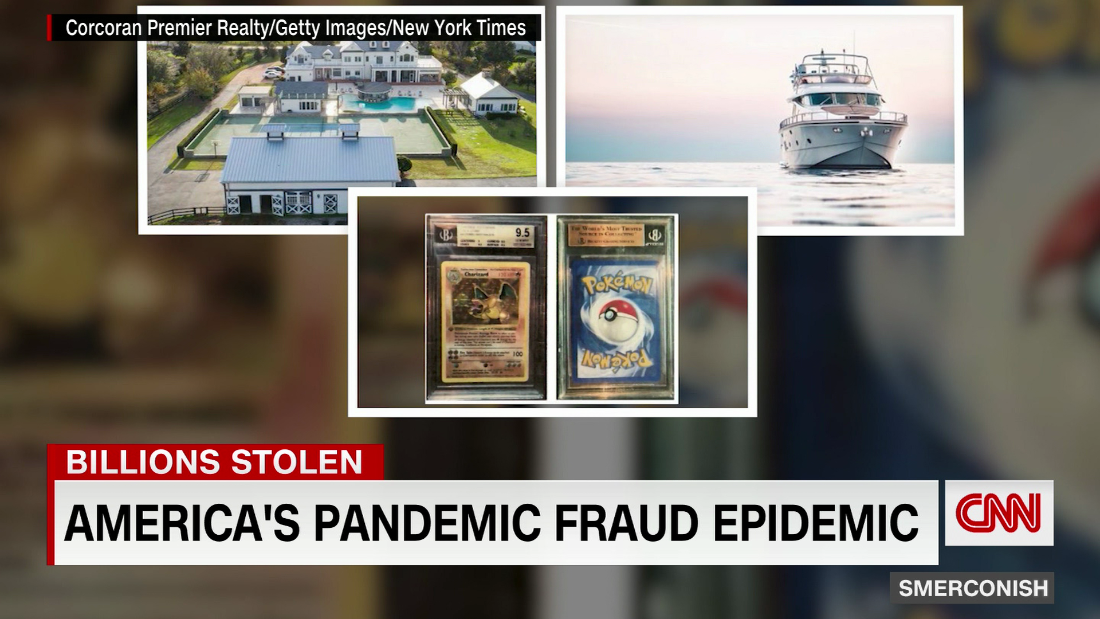

The scale of the problem becomes clearer when examining specific instances. A recent report by the Social Security Administration's Inspector General revealed concerning findings, although the exact details were not provided in this context. Furthermore, the GAO estimates that during the pandemic, upwards of $100 billion in unemployment benefits were lost to fraud, a testament to the opportunistic nature of criminals. Alarmingly, only $5 billion of these stolen benefits have been recovered, underscoring the difficulties in pursuing and recouping these illicit funds. This situation reflects the vulnerabilities within the unemployment insurance systems, exploited by fraudsters who "ran rampant during COVID," particularly in states like California with weak fraud protections, according to U.S. sources. The Pandemic Unemployment Fraud Enforcement Act, a legislative initiative, aims to recover taxpayer money lost to waste, fraud, and abuse, aligning with President Trump's mandate. Government estimates indicate that between $100 to $135 billion in unemployment insurance benefits were stolen by fraudsters, including gang members, prisoners, international crime rings, and hackers operating from locations like Nigeria.

Since 1990, the GAO has been a consistent voice of warning, releasing reports that highlight the vulnerabilities of federal programs. These reports consistently find that numerous federal programs funded by Congress are bloated, struggle to meet their objectives, and are susceptible to serious waste, fraud, abuse, and mismanagement. The GAO has made numerous recommendations to Congress and federal agencies, offering guidance on how to reduce improper payments and fraud, and has identified specific actions that Congress could take to strengthen internal controls and financial and fraud risk management practices. In March 2022, the GAO identified 10 such actions, providing a roadmap for improving governmental efficiency and safeguarding public funds. Kristin Kociolek of the GAO also told a House Oversight Subcommittee that the government was defrauded of between $233 billion to $521 billion per year between 2018 and 2020. The scale is concerning, and emphasizes that there needs to be an urgent improvement in the internal controls and financial risk management practices across the government.

However, there are varying viewpoints on the extent of the fraud. While government investigations and audits reveal significant losses, other viewpoints also exist. Economists, for example, have questioned the accuracy and magnitude of the fraud figures being cited. These individuals suggest that the actual levels of fraud might not be as high as some reports claim. Despite these differing perspectives, the evidence of systemic issues cannot be ignored. The sheer volume of reported losses, the legislative responses, and the GAO's ongoing assessments all point to a significant challenge in protecting taxpayer dollars.

Adding complexity to the narrative is the intersection of government and private sector operations. In 2025, Elon Musk and the Department of Government Efficiency (DOGE) teams gained access to large parts of the United States federal government. The implications of this event, specifically the subsequent actions taken and their impact on public records and governmental transparency, require careful consideration. Tens of thousands of United States federal government employees were laid off or fired as a result. Many public records were modified or removed from federal websites and databases, adding to public concerns.

It is critical to understand the context of these fraud issues within the broader landscape of government operations and policy. The ongoing efforts to combat fraud reflect a continuous struggle to balance program efficiency, security, and responsible stewardship of public resources. These efforts represent a crucial focus for Congress and federal agencies alike.

| Area | Details |

|---|---|

| Fraudulent Activity Type | Unemployment Benefits Fraud, Waste, Abuse, and Mismanagement of funds |

| Entities Involved | Fraudsters, Gang Members, Prisoners, International Crime Rings, Hackers, Social Security Administration, US Government Agencies, States like California |

| Legislation/Acts | Improper Payments Elimination and Recovery Act of 2010 (IPERA), Payment Integrity Information Act, Pandemic Unemployment Fraud Enforcement Act |

| Key Figures/Organizations | Chairman Comer, Government Accountability Office (GAO), President Trump, Elon Musk, Department of Government Efficiency (DOGE), Kristin Kociolek |

| Year Span | 2007-2025 (and ongoing) |

| Estimated Losses | $41 Billion (2007), $104 Billion (2009), $149 Billion (2018), $100 Billion+ (Unemployment Benefits), $233 Billion - $521 Billion per year (2018-2020) |

| Recovery Rate | $5 billion recovered (out of $100+ billion in unemployment fraud) |

| Actions/Recommendations | GAO Recommendations to Congress and Agencies, Strengthening Internal Controls, Financial and Fraud Risk Management Practices |

| Major Events | Enactment of IPERA, Replacement of IPERA with the Payment Integrity Information Act, GAO's 2025 High Risk List, Pandemic Unemployment Fraud, Musk & DOGE involvement (2025), Layoffs and record modifications. |

For Further Reading:

Government Accountability Office (GAO) Official Website