Truist Exceptions/Administrative Hold: What You Need To Know

Is your money suddenly inaccessible, leaving you stranded and frustrated? Understanding the reasons behind a bank's "exceptions administrative hold" is crucial to navigating these financial roadblocks and reclaiming control of your funds.

The scenario unfolds with unsettling speed: a deposited check, initially anticipated to clear, is flagged with an "exceptions administrative hold." The promise of release on a specific date, often preceded by an "investigation," offers little solace when your debit card is abruptly rendered useless. This situation is not uncommon, and its essential to understand the underlying causes and potential recourse.

| Scenario | A customer deposits a check and receives an "exceptions administrative hold." The customer's debit card is then rendered unusable. |

| Bank Involved | Truist Bank |

| Issue Encountered | Funds availability delayed, card access restricted, and a general lack of immediate access to deposited funds. |

| Customer Complaints | Inconvenience, financial strain, and a feeling of being unfairly treated. |

| Possible Causes |

|

| Relevant Regulations | Regulation CC (Funds Availability Policy) |

| Expert Insights | Legal professionals and banking experts offer advice and clarify the legality and validity of such holds. |

| Potential solutions |

|

For more detailed information, you can consult the official Truist website or seek guidance from legal experts who specialize in banking law. Truist Bank Official Website

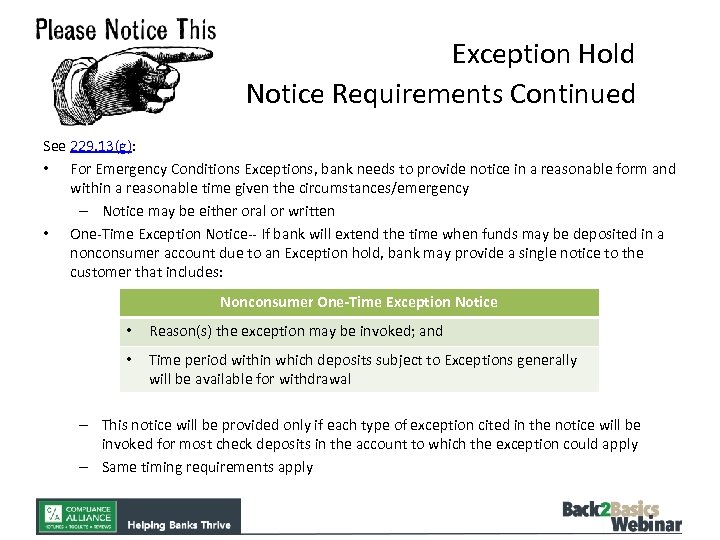

The mechanics behind these holds are governed by Regulation CC, formally known as the Funds Availability Policy. This federal regulation provides the framework for how financial institutions manage check holds, balancing the need to protect themselves from risk with the customer's right to timely access to their money. This regulation provides six exceptions that allow banks to extend deposit hold periods.

A common trigger for an "exceptions administrative hold" is a "large deposit." While the specific threshold varies by bank, a deposit significantly exceeding a customer's typical transaction patterns can raise red flags. Similarly, a new account, generally defined as being less than 30 days old, is often subject to stricter scrutiny. Banks may impose holds on checks deposited into new accounts as a precaution, as they haven't yet established a transaction history to assess risk.

The bank will do this to ensure the funds clear before they are made available in your account. A hold is put in place to protect you as much as it protects the bank.

The banks suspicion of fraud or the potential for a check to bounce also triggers an exception hold. This can be a significant source of frustration, especially when the customer believes the deposit is legitimate and expects immediate access to the funds. Banks are obligated to investigate these situations to mitigate their own risk. They may also place exception holds based on a history of overdrafts or if a check has been redeposited after initially being returned for insufficient funds.

The bank's internal policies and procedures also play a crucial role. While Regulation CC provides a baseline, individual institutions can implement more specific protocols for handling deposits, especially those made through mobile banking or ATMs. For example, depositing a large check via mobile deposit might be flagged more readily than if the same check was presented to a teller. This is, in part, due to the increased risk of fraud associated with digital deposits.

The terminology employed by banks can add to the confusion. Phrases like "exceptions administrative hold" or "reasonable cause to doubt collectibility" may seem vague. However, they are rooted in specific regulatory guidelines. The key to understanding these holds lies in unraveling the bank's stated reason for the restriction and the specific regulation or policy it cites.

Consider the scenario where you've sold an item online and receive a Western Union money order as payment. While seemingly secure, this type of payment is, in essence, a check deposit, subject to standard hold times. If a bank suspects the money order is fraudulent, an "exceptions administrative hold" is a likely outcome.

Some individuals have reported administrative holds on checks deposited from other accounts within the same bank, accounts which supposedly had available funds, suggesting that the checks should have been cleared immediately. In this situation, the customer is left to question how the bank can claim "doubtful collectability."

The impact of an administrative hold extends beyond mere inconvenience. It can create a domino effect. Suddenly, access to essential funds is blocked. Bills go unpaid, and planned transactions fall apart. This highlights the critical importance of understanding the bank's hold policy and knowing the potential consequences of large or unusual deposits.

The fact that the bank took some random amount, which ended up being most of the loan and put the 'exceptions/administrative hold' tab on it, is a common occurrence. These are the reasons why it's critical to always understand your bank's practices and have a plan if this happens to you.

A crucial factor in navigating these situations is the age of the account. For accounts less than 30 days old, banks have a more cautious approach, as the risk profile is not yet established. The exception hold reasons are large deposit, repeat over drafter, redeposited item, new account, reasonable cause to doubt collectibility, and emergency conditions. If a hold has been placed, it's very likely to impact your immediate access to funds.

This raises an important question: what recourse is available? The first step should always be to contact the bank and inquire about the reason for the hold. Requesting documentation and referencing Regulation CC can be helpful in clarifying the banks position. Providing any supporting evidence, such as proof of the transaction or the legitimacy of the check, can expedite the process.

The bank might cite "doubtful collectibility" as the reason. This could be applied, if the bank is unable to verify the check.

Unfortunately, certain steps, such as closing an account with a balance exceeding $100,000, may not be possible over the phone. If you want to close your account, in these circumstances, the process can be tedious.

While banks are obligated to follow federal regulations, understanding these rules is only one piece of the puzzle. The other is knowing your rights and how to exercise them.

In contrast, if a teller processed the transaction, there would have been an opportunity to address the issue immediately. The ability to lift a hold immediately is often contingent on the circumstances. This can be the difference between a minor inconvenience and a significant disruption.

Another important factor to consider is where the deposit was made. Teller could have lifted the hold immediately. If such a large amount isn't normal for you, would recommend taking it to a branch everytime. Too much check fraud through mobile deposit.

The bank's stated reason for the hold can sometimes be a source of frustration. For example, if the bank is holding funds from checks deposited from another of your truist accounts that clearly has the funds! So, how can they claim there is a risk of doubtful collectability?

The issue is further complicated when considering that some banks assert contractual rights to set off funds on deposit in response to customer actions.