Compound Interest: Unlocking Your Financial Future | Learn Now!

Are you ready to unlock the secrets of exponential growth and financial success? Compound interest, often hailed as the eighth wonder of the world, holds the key to significantly multiplying your investments over time. This article delves into the intricate world of compounding, exploring its mechanics, benefits, and the potential pitfalls you should be aware of.

Imagine starting with an investment of $960,000. Without even considering the magic of compound interest, this is a significant sum. However, the true potential lies in the power of compounding. If you were to assume a modest 5% annual compounding rate a figure often considered conservatively low your initial investment could balloon to almost $3 million over time. This illustrates the remarkable ability of compound interest to transform modest sums into substantial wealth. Consider another scenario: investing $200 per month for 40 years at a 10% annual return could yield just over $1 million. While this may seem like a significant figure, when adjusted for inflation, it equates to roughly $480,000 in today's dollars, highlighting the importance of considering the impact of inflation when evaluating investment returns.

| Understanding Compound Interest: A Primer | |

|---|---|

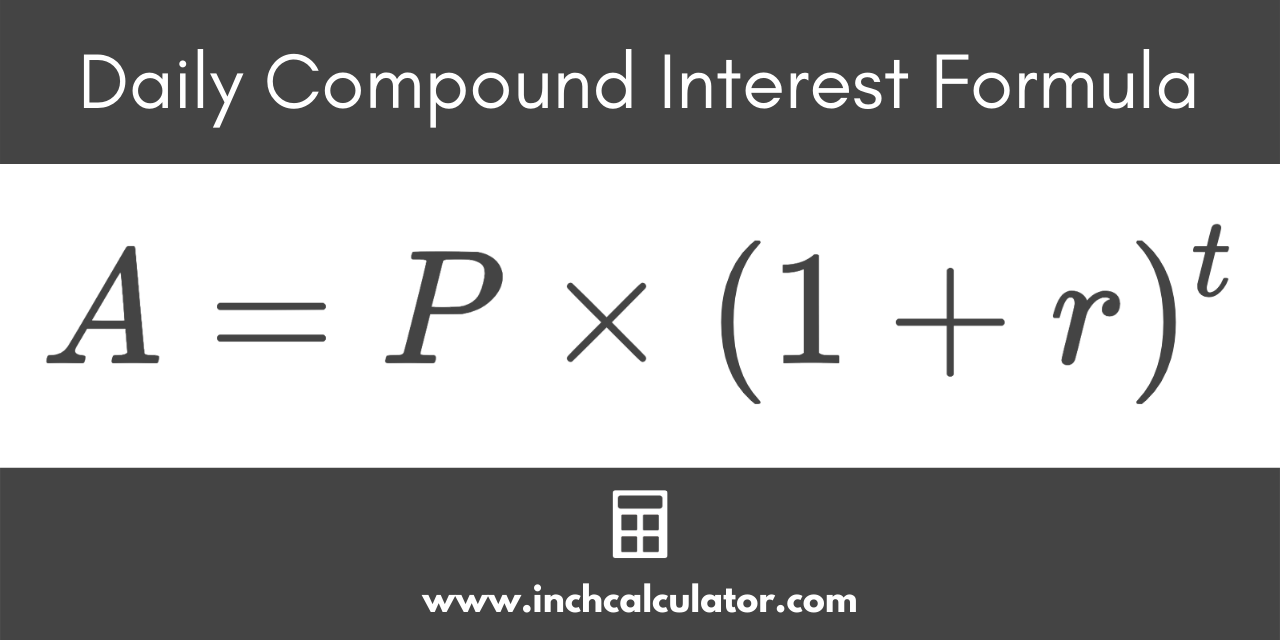

| Definition: | Compound interest is the interest earned not only on the initial principal but also on the accumulated interest from previous periods. |

| Frequency: | The more frequently interest is compounded (daily, monthly, quarterly, annually), the faster your investment grows. Daily compounding generally yields the highest returns. |

| Key Factors: | Interest rates, the amount invested, and the investment timeframe significantly influence the power of compounding. |

| Real-World Example: | Investing $1,000 at a 5% annual interest rate, compounded annually, would yield $1,050 after one year. After two years, the interest is calculated on $1,050, not just the initial $1,000. |

| Impact of Time: | The longer your money compounds, the more dramatic the effect. This is why starting early is crucial for maximizing returns. |

| Important Consideration: | Inflation erodes the purchasing power of money over time. The real return of an investment is the nominal return minus the inflation rate. |

Several platforms claim to offer daily compound interest accounts, promising rapid growth. Tellus is one such platform. They claim to allow users to deposit money and earn interest daily. The interest rate, they state, is subject to change, varying based on factors like current market rates, any available boosts, and the specific account type you open. The concept of daily compounding is certainly appealing, as it promises to accelerate the growth of your investments compared to less frequent compounding periods. Daily compound interest accounts, by their nature, compound interest on a daily basis. This means interest is calculated and added to your principal every day, allowing you to earn interest on your interest more frequently.

The allure of high returns can sometimes be deceptive. One should exercise caution and conduct thorough research before investing in any platform. The banking industry is no stranger to attracting new customers with an appealing Annual Percentage Yield (APY) only to lower the rate later. Be wary of any financial institution that significantly lowers the APY of the interest. Furthermore, it is important to consider the risks associated with any investment, including the potential for loss. Before making any investment decisions, be sure to evaluate the risk involved and consider your personal financial situation.

Compound interest is a potent financial concept. The compound interest required reduces to get another multiple of your investment. This is because as your investment grows, the interest earned also increases, leading to accelerated growth. Daily compounding is a practice that involves compounding interest on a daily basis, thereby increasing the frequency of interest calculations. This accelerated frequency of compounding allows investors to earn interest not only on their initial investment but also on the interest earned on a daily basis.

The concept of compound interest isn't just theoretical; it's a powerful force that can dramatically impact your financial future. To realize its full potential, your investments need to accumulate interest at favorable rates. For instance, at a 15% compound annual rate, an investment can quadruple. And at a 17% compound annual rate, your investment can quintuple. While these rates are on the higher end of the spectrum and may not always be achievable, they clearly demonstrate the exponential power of compounding.

However, it's crucial to approach these opportunities with a critical eye. Not all platforms offering compound interest are created equal. Some may be legitimate, while others could be scams designed to lure unsuspecting investors. It's essential to thoroughly research any platform before investing your money. Look for credible reviews, check for regulatory compliance, and understand the risks involved. Websites such as Compounddaily.org have received mixed reviews. Analysis of this website has produced a review with a trust score of 66%. This trust score places the website in a medium to low-risk category. While not necessarily a scam, it highlights the need for careful due diligence.

One common mistake many investors make is simply "putting their money away" in a low-yield savings account. While it may seem safe, the compound interest in such accounts is often negligible. To truly harness the power of compounding, you need to actively invest your money in vehicles that offer higher rates of return. The investment options should align with your risk tolerance and financial goals. This could include stocks, bonds, real estate, or other assets.

The world of investment is filled with complexities, and it is very important to remember to actively invest to see any significant returns. Depending on your bank, interest may compound daily, monthly, quarterly or annually. The frequency of compounding significantly impacts the growth of your investments. The more frequently interest is compounded, the faster your money grows. Some platforms may offer attractive rates initially but then lower them without notification. This practice can erode your returns and is a red flag that should be carefully evaluated.

Beyond traditional investments, the concept of compounding also extends to other fields. Compounded medications are a prime example of this principle in action. Compounding pharmacies create customized medications tailored to individual patient needs. Unlike mass-produced drugs, compounded medications are often formulated with specific dosages, ingredients, or delivery methods. While compounded medications have an essential role in medicine, they also pose specific risks. Because they are not manufactured on a large scale, compounded medications are regulated by state boards of pharmacy. Therefore, the standards and oversight can vary widely from state to state. This means not all compounding pharmacies adhere to the same stringent quality standards as large-scale drug manufacturers.

When researching financial platforms, it is wise to seek out diverse sources of information and expert advice to make informed decisions. The analysis of websites such as Compounddaily.org and compoundeddaily.com provide insights into their trustworthiness and safety. Websites that feature positive trust scores and high safety ratings indicate a strong level of security and reliability. It's always wise to be careful and investigate before investing any money. Take the time to review any site you plan to do business with. Evaluate the security measures and understand the risks involved. Also, look for reviews and ratings from independent sources to gain a more comprehensive view.

In essence, understanding and leveraging the power of compound interest is crucial for achieving long-term financial goals. From daily compound interest accounts to actively managed investment portfolios, the options are varied. Whether you are looking to grow your wealth, plan for retirement, or simply secure your financial future, compound interest is an incredibly effective tool. While some opportunities may seem appealing at first glance, always prioritize thorough research, prudent risk management, and a long-term perspective.